- CALL US (404) 814-1814

- LIVE SUPPORT

- EMAIL US

-

WISHLIST (0)

-

CART(0)

Rolex Financing Options

If you’ve been eyeing that Rolex watch for a while, but don’t have enough cash saved, it might seem like owning it is just a dream. The concept of paying over time for a Rolex isn’t popular, and might even seem too good to be true, but it is possible! In fact, if you’re using a trusted provider, financing your Rolex might just be the better option.

You can enjoy your Rolex watch sooner than you think. With a personalized financing plan, you can tailor the amount you’ll pay according to your needs and capacity, and pay for it in convenient monthly installments. Learn more about Rolex financing options with our guide.

Why Opt For Rolex Financing?

If you have enough cash set aside, paying upfront for your Rolex timepiece is still the best option. However, the watch you want may be elusive and in high demand, and you certainly don’t want it to get away. If that’s the case, financing is a good alternative. You can get your watch now and pay for it over a set period of time.

How Does Rolex Financing Work?

Financing a Rolex watch means you'd likely pay installments over a set period instead of paying the entire amount at the time of purchase. There are several ways to make payments on a Rolex watch, which we discuss below.

At SwissWatchExpo, we’ve partnered with Affirm so you can pay off your purchase in an easy, fixed payment at rates of 0-36% APR. Affirm also allows financing for all of the nearly 40 brands we carry - including Rolex, Omega, Cartier, Patek Philippe, Breitling, Audemars Piguet, and more.

FREQUENTLY ASKED QUESTIONS

If you’re set on getting that Rolex watch from SwissWatchExpo and financing it through Affirm, here are a few FAQ’s to help you get started.

Am I eligible for a 0% APR loan?

When you apply for a loan, Affirm takes a number of factors into account, such as the current economic conditions, and your personal eligibility. These include things like your credit score – and if you have an Affirm account – how long you’ve had the account and your payment history with them. To pre-qualify, click on the item of your choice at SwissWatchExpo.com, and click Prequalify Now. Checking your eligibility won’t affect your credit.

For more information, please see How Loan Approvals Work.

Does my watch come with a warranty?

At SwissWatchExpo, we stand by all our watches with a full 18-month limited warranty.

If the watch that we sell you fails because of a manufacturer's defect within the first 18 months, we will repair or replace the item at absolutely no cost to you. If your watch shows any signs of not keeping proper time, please don’t hesitate to contact us. Should we determine that a repair under warranty is required, our watch experts will guide you on how to safely ship the watch to us.

Here are full details about our 18-month limited warranty.

How long does it take for Affirm to process my financing request?

Your purchase is finalized around the time that SwissWatchExpo ships your order. You will get an update from Affirm usually within 2 business days after that. Affirm will send you a confirmation email, where you’ll see exact due dates for your monthly payments.

How do I sign up for Affirm?

You can sign up at SwissWatchExpo, at affirm.com, or using the Affirm app.

When you sign up through SwissWatchExpo, you can find out if you’re eligible with just a few easy steps. To pre-qualify, click on the item of your choice at SwissWatchExpo.com, and click Prequalify Now. This step will not affect your credit score.

What is required to have an Affirm account?

To sign up for an Affirm account, they will ask for a mobile number from the US or US territories. This helps them verify that it is really you who is creating the account or signing in.

How do I buy an item with Affirm?

Go to the product page of your desired watch at SwissWatchExpo.com, then click on Prequalify Now beside the Affirm logo. You will be asked to see if you qualify with just 5 pieces of info.

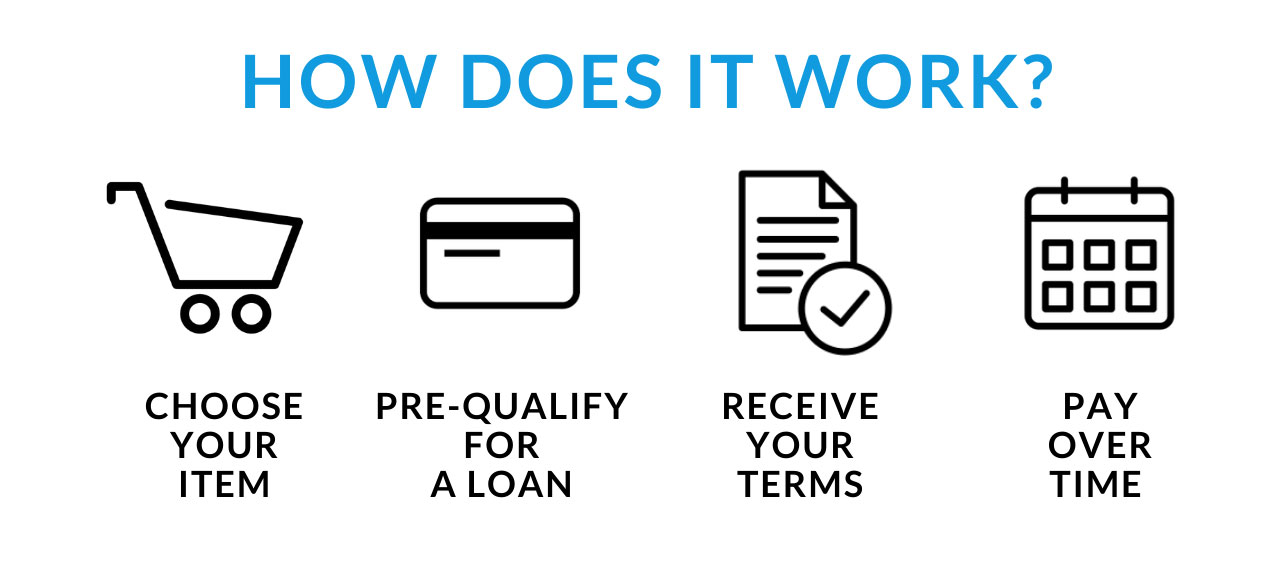

FINANCE YOUR WATCH AT SWISSWATCHEXPO

We believe that getting your Rolex timepiece should be within reach. We’ve partnered with Affirm to help you buy your dream Rolex watch with ease!

We make it simple with just four easy steps:

Go to the product of your choice at SwissWatchExpo.com.

On the product page, click on Prequalify Now. With just 5 pieces of info, you’ll get a real time decision.

Select the monthly amount and payment schedule that works for your budget, then confirm your loan. You will never be charged more than this fee.

Make easy monthly payments through the Affirm app or by signing in at affirm.com. Affirm will send you email and text reminders so you’ll never miss a payment.

*Rates from 0–36% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license. For licenses and disclosures, see affirm.com/licenses. For example, a $800 purchase could be split into 12 monthly payments of $72.21 at 15% APR.

ROLEX FINANCING: 4 WAYS TO PAY FOR YOUR ROLEX

A luxury watch is a major investment and it often makes sense to spread out the cost over time. If you’d rather pay in installments than in one lump sum, then financing is the right option for you. Here’s a comparison of 4 ways you can finance your Rolex watch, and which option might be the right one for you.

1. Layaway program

How it works: The item will be held by the store while you pay for it over time. You will get the merchandise when you’ve fully paid for it. SwissWatchExpo does not offer layaway payments as of 2021, but feel free to contact us to check if this policy has changed.

Layaway programs allow you to pay for items in installments, but this arrangement means that the store will keep the item until it has been fully paid off and can be taken home. You will be asked to put a down payment, and possibly a finance charge, although layaway programs do not charge interest. There may also be restocking or cancellation fee in some cases.

There are no credit checks or eligibility requirements with layaway programs, but a percentage of your payments may be non-refundable if you withdraw from the program.

This is for you if: You have less-than-ideal credit score and don’t mind waiting for the item.

2. Affirm loan

How it works: Affirm is a lending company offering a buy now, pay later option with fixed monthly installments, fixed 0-36% APR, and no-late-fees. The typical time frame is 12, 24 or 36 months.

Affirm is a lending company that provides point-of-sale financing for partner vendors like SwissWatchExpo. To qualify, you would need to find a vendor that offers Affirm financing at checkout. There is a pre-qualification process where they will ask 5 questions at checkout and you will get an instant decision. The monthly payment amount will be based on the number of payments you choose. While Affirm does not charge compound interest or late fees, they will check your credit score and your payment history with Affirm.

This is for you if: Affirm is offered by your chosen vendor, and you have solid credit which qualifies you for a manageable interest rate.

3. Credit card

How it works: Buying a watch using a credit card means using a revolving line of credit. You pay for the amount you’ve borrowed back in full or in monthly installments. In most cases, if you don’t pay for the balance in full, you will also be paying interest.

If you have strong credit, your card issuer might be able to offer an introductory 0% APR. This means you can pay off your balance within a set period, usually 12 to 18 months, without having to pay interest, thus making your Rolex purchase easier on the pocket. After this period, if you haven’t paid the amount of the watch in full, you can expect to pay interest on any remaining balance at a higher APR.

This is for you if: You are a good borrower and can qualify for a low introductory APR, and can also pay off the watch in a shorter timeframe.

4. Personal loan

How it works: Personal loans can be used for a variety of purposes, and you don’t have to specify what you are buying. These are loans that you can pay back with predictable monthly payments.

A personal loan is money borrowed from a bank, a lender, or a credit union that you can pay for with fixed monthly rates, and fixed interest rates, typically over two to seven years. They can be unsecured or not backed by collateral, and in some cases secured, or backed by an asset like your car or your home. Lenders decide whether to give you a loan based on factors like your credit score, credit history, debt-to-income ratio, and cash flow.

Like any form of credit, personal loans help build credit with on-time payments, while late payments can damage your credit score when reported to credit bureaus.

This is for you if: You have a strong credit profile that gives you a better chance of getting lower interest rates.